Table of contents

Your card transaction fees are about to go up from September - probably without you knowing - and here’s why. It all revolves around virtual cards and those dastardly OTAs and, frankly, there’s nothing we can do to stop them... for now...

Virtual cards were always touted as a benign financial innovation for hospitality businesses and, on balance, they have been. When they arrived after 2000, they offered a payment solution for those who didn’t have corporate cards and they helped reduce fraud, time filing expenses and time reconciling transactions. The OTAs found them particularly handy as they can be made available only for the day of arrival and can be charged for a specific amount and for just a single use. So they’ve always helped facilitate bookings and even the new wave of neobanks continue to get in on the virtual card act - Revolut recently launched disposable virtual cards that are destroyed after each transaction...designed for those shameless moments when you find yourself about to pull the trigger on a purchase from a dodgy-looking site…

In 2016 and 2017, research by HRS evaluated 30,000 hotel bookings for 12 corporate clients that implemented virtual card programs with AirPlus or American Express. Although the main finding of the report actually showed that the use of virtual cards drove down the average room rate paid by the corporate bookers by 12 percent, the results also revealed several other benefits of the impact of accepting virtual cards for hoteliers as well.

Travelers under virtual card programs tended to book more price-sensitive regional and local hotels with bookings in this hotel segment increasing from 30 percent to 40 percent following virtual card implementation. Travelers under virtual card programs also tended to book trips 11 days prior to travel, whereas they'd booked an average of 8.5 days in advance before virtual card implementation. The no-show rate also dropped an average of 15 percent following deployment. "With travelers knowing that payment for the stay is already in place, they appear to be less likely to cancel at the last minute," the spokesperson said. Hoteliers rejoiced...

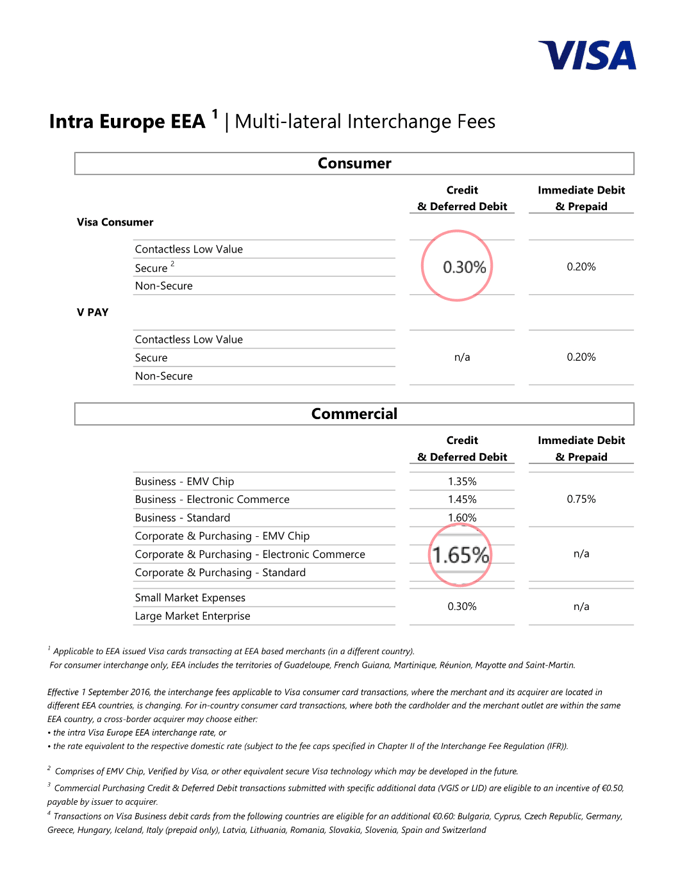

But, despite helping hoteliers on so many fronts, there’s one major uncomfortable truth lurking behind virtual cards and it lies in the murkiness surrounding the higher transaction fees - more specifically the interchange fees (more on these later) - associated with accepting them. Since 2015 within the EU, the interchange fees for consumer debit cards and consumer credit cards have been regulated and capped at 0.2% and 0.3% respectively. It was a win for hoteliers within the EU taking those types of payments but, unfortunately, virtual cards sit outside this regulation for consumer cards and the interchange fees are higher (think over 1.5%…). Outside of the EU these rates tend to be higher - the best example being the US.

The OTA's would rather hoteliers didn't know about it."

Although these fees have always been higher for virtual cards, there’s a new and ominous cloud on the horizon that’s going to drastically increase their use and impact hoteliers...

What’s changed? There’s a big new law about to be rolled out across the EU that’s what. In order to comply with the major financial legislation coming into force across the EU on September 14 - romantically known as PSD2 - the OTAs are going to be making a major strategic shift on how they process payments. In fact, we’ve already seen that the OTAs have already started to make their move…and they would rather hoteliers didn’t know about it...

OTAs are doubling down on virtual cards

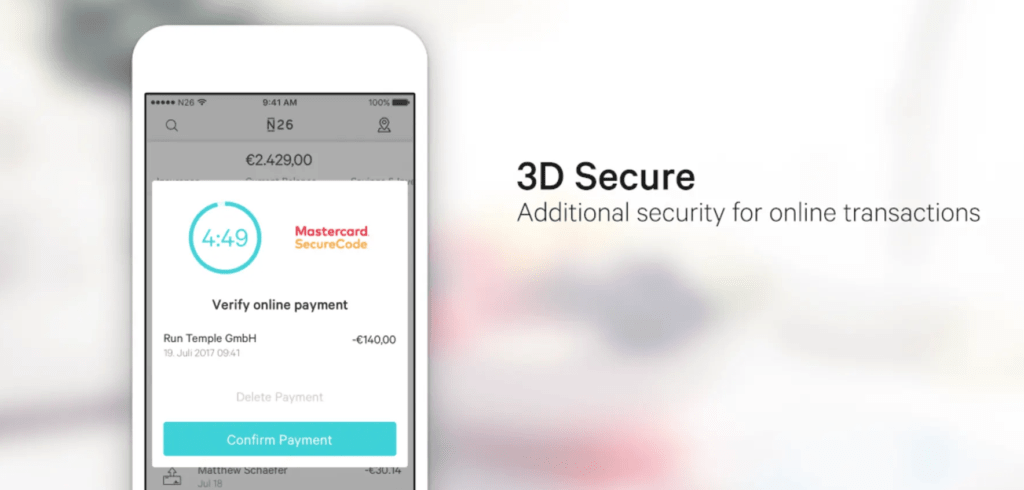

For the OTAs, the incoming PSD2 legislation and its requirement for strong customer authentication (SCA) presents them with a particular headache.

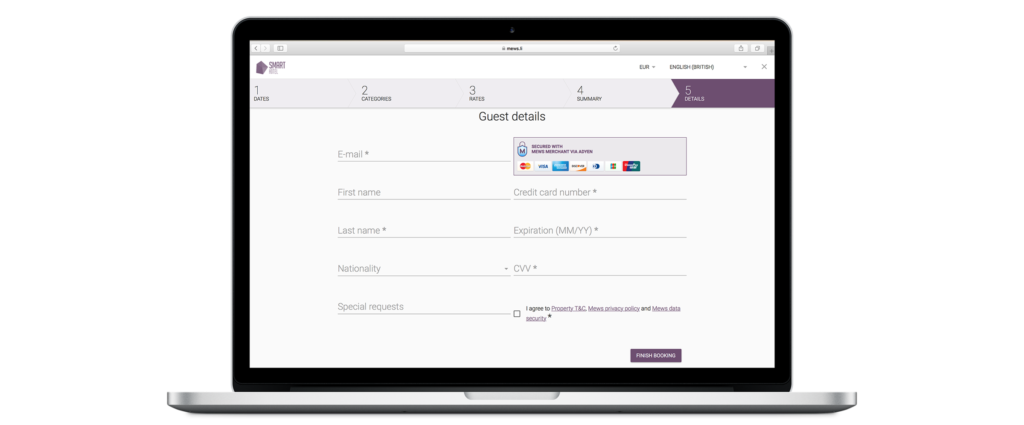

Let’s take a step back and remind ourselves of the two ways OTAs process online booking payments made by guests. They either pass on the payment card details directly to the property (eg. Expedia’s “Hotel Collect”) or they do not. In the case that they do not and they take the payment themselves, they will then issue a virtual card to send to the property (eg. Expedia Collect).

What would this hypothetically mean when it comes to authenticating payments and PSD2? In the first case of the OTA passing on the guest card details, it would mean that the hotel receives the raw card details and would be on the hook for authenticating the transaction. A bit of a messy payment checkout experience for the guest would follow involving being sent from website to website...and neither the guest, the OTA nor the hotel property wants that.

For the latter case where the OTA does not pass on guest card details, it would mean that the OTA would process the payment themselves and do the authentication through their own portal. Customer-wise, this is a lot more seamless and the customer avoids becoming an authentication hot potato passed from one website to another and won’t run the risk of being assaulted by a bombardment of separate pop-up 3D secure authentication windows.

In short, in order to comply with PSD2 we believe that the OTAs will be doubling down on issuing virtual cards. Why? It allows them to comply with PSD2’s authentication (SCA) requirements, it affords them a better customer checkout experience and, more cynically, we believe they may have cut deals with banks to share some of those higher fees...so don’t expect to see them passing on raw guest card data to you much more. The OTA will be the main payment processor and customer authentication will happen on their doorstep and when they take payment. We repeat - that means no more passing on of payment card details to your property. We’ve seen plenty of evidence that the OTAs have already started issuing more virtual cards in anticipation of September 14 and the big change date.

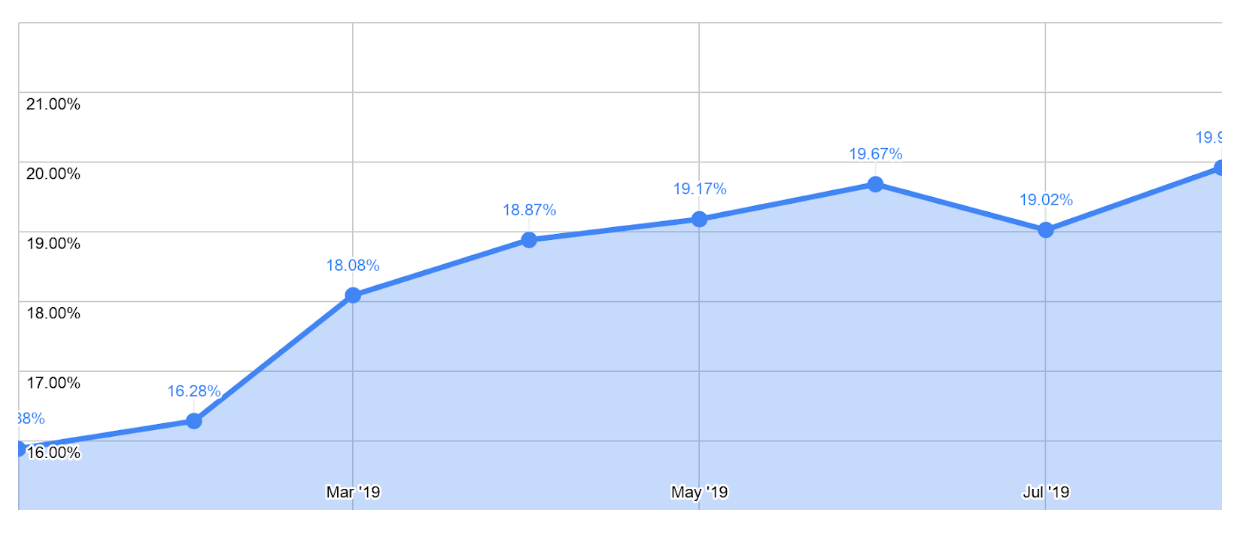

The chart below shows the share of virtual card usage as a percentage of total payments volume across thousands of hotels processing payments through Mews Payments. The uptick of virtual card usage has already started...

More virtual cards means higher transaction fees

So what does this brazen, but logical, move by the OTAs imply? It means you are going to pay a higher amount of card transaction fees because of the higher embedded interchange fees that all virtual cards carry.

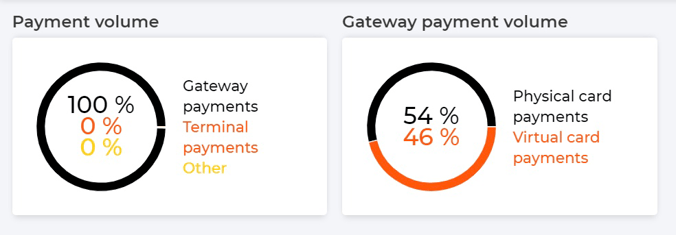

For the moment, there’s no way of avoiding this reality. In fact, knowing how many virtual cards you are accepting is such an important line item to keep an eye on for hoteliers that we recently updated our payment reporting feature to help our hoteliers visualise their virtual card mix.

How much will this cost you?

Here’s what we know:

Hoteliers pay transaction fees for every payment processed. In case you missed it, there’s a big fat line in your accounts for this. More specifically, the vast majority of hospitality businesses are charged on an Interchange++ Pricing Model, including Mews users.

What this means is that your transaction fees are actually not a single fee but a mix of three different charges: 1) Scheme fees 2) Interchange fees 3) Merchant Service Charge. Scheme fees are the fees the likes of Visa and MasterCard charge for using their network and these are set based on transaction types and regions and none of us mere mortals have much say in changing them. They are typically much lower (ranging from 0.1% to 0.65% for example) than the other fees so fluctuations don’t impact the bottom line as much.

The Merchant Service Charge, assuming you are a Mews user and processing payments through our integrated Payments solution, is the normal fee (ie. it’s not a markup) we at Mews charge for processing payments. But if you use another payment solution they will charge their own commission that you would have agreed upon and won’t fluctuate.

Fees you pay could jump 153%...

So 1) and 3) - the Scheme fee and the Merchant Service Charge - won’t be susceptible sudden changes or swings. Almost ALL the variation in the transaction fees you pay will come from 2) - the Interchange fees. And it is these fees hoteliers and their finance teams need to understand as well as possible. It’s also where the OTAs and others cut nefarious deals with the banks that impact you as an hotelier... but that’s for another article.

So, it’s all about the Interchange fees and we know that a normal online guest booking with a credit card comes with an interchange fee of 0.3% currently (or 0.2% for debit cards), which is regulated and set by the EU authorities. We also know that virtual cards come with a much higher fee of 1.65% for the likes of Visa or MasterCard. So, if all your bookings come from within the EU then this is roughly (the rate cards are a bit more detailed…) what the mix of your interchange fees would look like. Non-EU payments would make this rate creep up as interchange rates tend to be much higher and not as regulated as within the EU. For now, and to make the mathematical case, let’s assume all your payments come from within the EU.

Here’s an example of the kind of confusing rate sheet you may have been shown and we’ve highlighted what you should be focused on:

Now imagine a most rudimentary case - Ed’s Motel has 100 rooms and charges €100 per room per night. All rooms get booked directly by EU card holders so 100 percent of your payments get hit by the applicable 0.3% Interchange rate.

100 x €100 = €10,000

€10,000 x 0.3% = €30

That means you pay €30 of Interchange fees.

Now imagine the very same Ed’s Motel that gets the same number of bookings at the same rate but gets paid by virtual cards at the applicable 1.65% Interchange rate

€10,000 x 1.65% = €165

That means you would pay €165 on Interchange fees on the same volume of business simply for taking virtual cards.

That’s 5.5x more in fees. Now imagine if all your direct bookings suddenly became virtual cards? That would imply that big fat 'transaction fees' line in your accounts would become 5.5x bigger.

Now let’s make things a smidgen more complex (and more realistic). Half of your business comes from OTAs and half from direct bookings. So that means you are actually now facing a blend of Interchange fees depending on the type of payment you are processing. We can assume that the 50 percent of your direct business gets charged at the applicable 0.3% Interchange fee. But your OTA bookings are complicated as half of those are virtual cards and half are payment details sent directly to you.

€5,000 x 0.3 = €15

€2,500 x 0.3 = €7.5

€2,500 x 1.65 = €41.25

So the Interchange fees you currently pay are the sum of all of the above or €63.75.

Now here’s the rub - imagine if the OTAs decided to send all their business as virtual cards...it would look like this:

€5,000 x 0.3 = €15

€5,000 x 1.65 = €82.5

So the total Interchange fees you pay jumps up to €97.5. That’s a 153% increase in fees...

Now you can fiddle with the numbers all you want to apply to your own situation but one thing is for certain - if you have a decent amount of business coming from OTAs AND a lot of that business is from EU individuals (with EU issued cards) then your fees you pay are about to leap up as the big bad OTAs start sending through more virtual cards.

Caveat emptor...

Who will this impact the most?

These changes will have the most impact for properties in the EU that serve a mainly EU client base who pay online with cards issued from within the EU. After all, PSD2 is legislation that is a European directive...

The interchange rates on cards that are issued from outside of the EU are not as regulated or controlled so the rates you pay on them are unlikely to change much as they are already higher. So it’s likely to be the case that if, for argument's sake, all your bookings come from non-EU issued cards then there will be little change in the transaction fees you pay.

Author

Mews

Essential hotel technology for general managers

Download now

Hospitality hot takes straight to your inbox

.webp)