How was 2022 for you? Are you happy with your property’s performance? Sometimes it can be tricky to answer this question without wider context; specifically, wouldn’t it be great to see how your property performed compared to the industry average?

Welcome to the Mews Data Dive: 2022 H2. This biannual report analyzes anonymized data from thousands of hotels, hostels and serviced apartments and distills it into 11 key areas.

As well as assessing how the second half of the year compared to the first six months, it also dives into long-term trends to see if hospitality has returned to its 2019 base line.

In short, it’s packed full of industry insights and it also looks super stylish. What’s not to like?

What’s in the Mews Data Dive?

The Mews Data Dive: 2022 H2 examines 11 key areas that affect all hoteliers. They are:

- Occupancy

- Domestic travel

- Direct booking by property type

- Booking lead times

- Rate types

- RevPAR and ADR

- Additional bookable services

- Online check-in and upsells

- Hotel staff

- Chargebacks

- Integrations

Overall – spoiler alert – the data presents a positive picture for hospitality. Traditional success indicators like occupancy and RevPAR are performing well, and the adoption of technology and greater connectivity across operations shows no sign of stopping.

Some of the report’s key findings include:

- End of year occupancy levels exceeded pre-Covid (2019) levels

- Year-on-year booking lead times have increased by 11 days to a 31-day average

- ADR and RevPAR consistently outperform all previous years

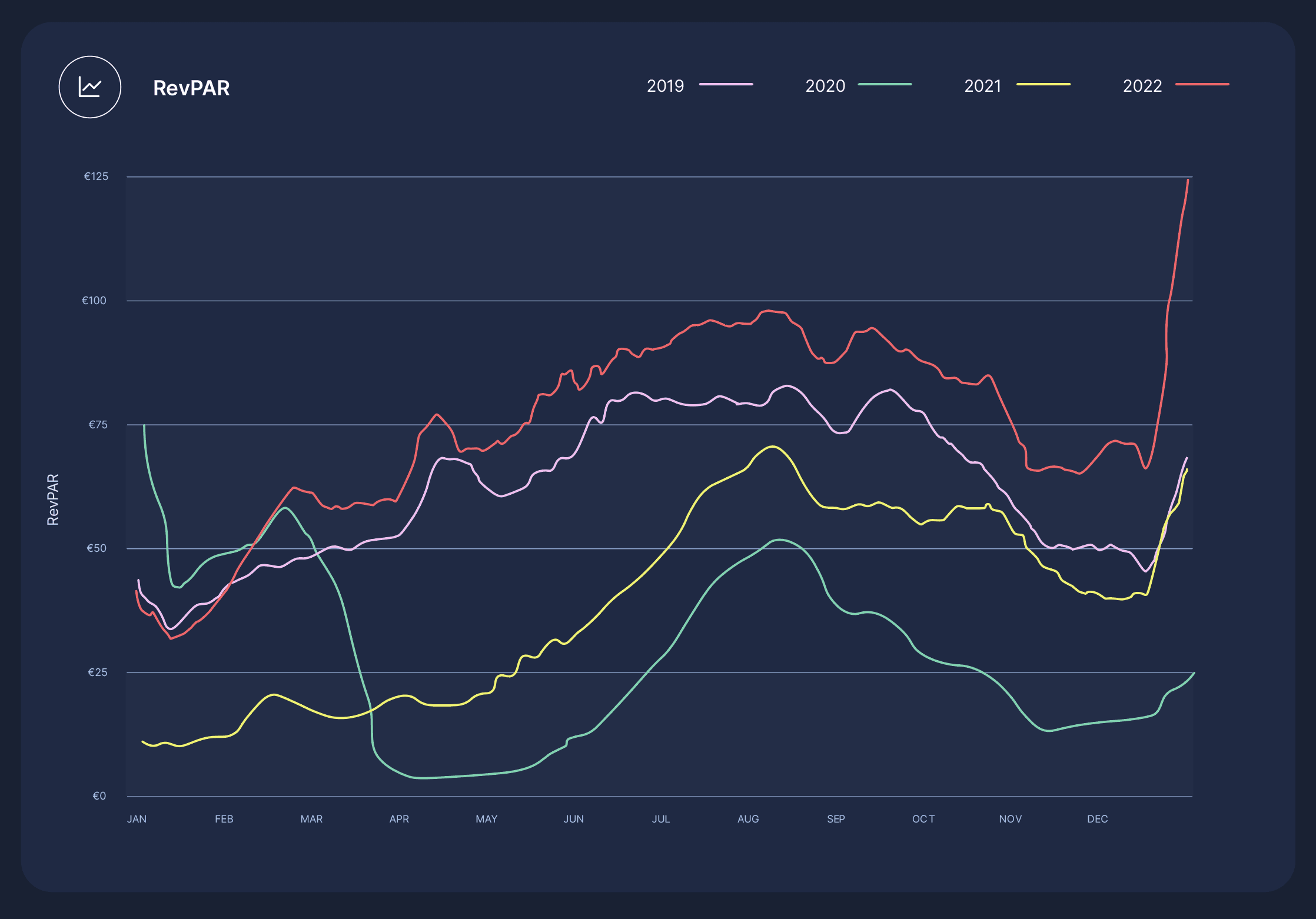

RevPar and ADR

By way of example, let’s take a closer look at RevPAR and ADR performance.

Headline news

Both RevPAR and ADR continue to maintain a healthy advantage over each of the last three years of data. Compared to 2021, RevPAR was an average of 92% higher in 2022. ADR was 34% higher. The excess was at its highest in the summer, and then the gap narrowed (but remained substantial) during the latter part of the year.

The rise in ADR from H1 to H2 this year was the same regardless of the day of the week. However, RevPAR rose a little more quickly during weekdays than at weekends.

What does this mean?

The positive RevPAR and ADR trends continue what we saw in the Mews Data Dive for H1 2022. The early pandemic rate uncertainty is long gone. In its place, record ADR paired with occupancy that’s virtually a par for 2019 (when ADR was 28% lower than 2022) makes for higher RevPAR. It’s a trend that holds true across all property types, so hoteliers all over the world are generating more revenue for their spaces.

The fact that RevPAR rose faster during the week than at weekends over the last six months might hint at the gradual return of business travelers – a very encouraging sign for our industry.

This is only one of the 11 key areas we explore. There are ten more waiting for you in the guide so don’t be shy.

Written by

Tom Brown

When Tom isn't creating outstanding marketing content for Mews as Principal Copywriter, he writes fiction for himself. Either way, he only uses the best words.