What does the future of Mews look like? And what does the future of hospitality look like? In effect, this is the same question, so we took a deep dive into the details in Our Vision for Hospitality session at Unfold 2021.

Nobody in hospitality has a crystal ball, but if anyone did it would be Jirka Helmich, Mews Chief Product Officer, and Aldair Borges, Product Manager. The pair looked ahead to how our industry will evolve in the near future, including subscription hospitality and buy now, pay later. You can rewatch the whole webinar, or you can read on for some of the fascinating highlights.

The age of the subscription model

“Lea Hickman was a product manager at Adobe,” explains Aldair, “who came up with what seemed a crazy idea at the time: moving from CDs, which had a single version of the software, to the cloud, providing users with a wide variety of software, with continuous use. By providing a subscription model, they didn't have to purchase something that would expire over time and essentially lose value as they go.”

Now, subscription models are everywhere. Think about how many you have. Netflix were another pioneer of this model, beginning with a physical DVD subscription before switching to streaming. It’s faster, more efficient, and means customers can forget about transactional processes like payments or returning items, and instead just enjoy the experience. And it’s great for the bottom line: companies like this grow an average of seven times faster than traditional businesses.

Closer to home in the travel industry, Prince Airlines from India have also started a subscription model, albeit on the more luxurious end of things. Their model means you can travel anywhere with them for a fixed price, and their business is soaring as a result.

“Soho House run a subscription model within hospitality, and during the first year of the pandemic they kept 90% of their members,” explained Jirka. “That meant a steady stream of revenue while everyone else was trying to figure out how to make some money.” citizenM are another success story; although historically focused on attracting the business traveler, they recently refocused on digital nomads, introducing a global passport subscription that lets you explore their properties around the world for a flat fee.

Tips for adopting subscription hospitality

Mews also runs on a subscription model, so we have a little expertise in the matter. Although we’re B2B software as a service (SaaS), it only takes a little adjustment to think in terms of hospitality as a service (HaaS). There are six key metrics that we use from the subscription industry, but how can they be adapted to hospitality specifically?

1. Customer acquisition cost (CAC) or Member acquisition cost

This is a metric that you should already be familiar with. It’s particularly useful when broken down by channel – for instance, so you can see the cost of acquiring a guest through a direct email campaign vs the cost of acquiring a guest through an OTA. That’s how to think in terms of acquiring guests, but what about acquiring members?

“Acquiring a member is a little more expensive, but it has its benefits in the long run,” Aldair explained. “You have to spend a lot more time convincing someone that there is lifetime value in using your services at your facilities. It's not about voucher codes anymore – you're really trying to get someone to engage with you and build a lifestyle. This is something places like lifestyle brands have started to get really good at: really understanding who their members are and giving them all the services they need that keep them coming back.".

2. Customer lifetime value (CLV / LTV)

The traditional means of increasing a customer’s lifetime value tracks a familiar user journey. There’s a big initial spend to acquire the customer in the first place, followed by upselling. Once their stay is over, you’ll probably try to retarget them through marketing, keep them engaged and hope they come back, spend a little more, buy a few more add-ons. And so on and so on.

Approach LTV from a subscription perspective and it changes the dynamic. Yes, the initial spend is more, but rather than investing large amounts after that in persuading the guest to return, you’ve built a relationship so you don’t have to. And then you suddenly have a more predictive revenue model for a longer period. You know where your revenue's coming from, and you can also then afford to make wiser decisions in terms of forecasting when you think of revenue management.

This has a big effect on how you need to think of your guests. “Suddenly every single guest becomes a returning one,” said Jirka. “They will invite friends to come over, to have a chat with them, to have a meeting with them, to have a coffee with them. They really need to get the feeling that they are at home, because your living spaces will become their new home that they will use as a safe harbor whenever they are in the city. And they will keep coming back because they have that subscription.”

3. LTV:CAC

So we've discussed how LTV and CAC affect the day-to-day in multiple industries. If you actually break it down to really understand the value of it, the lifetime value of your customer becomes 3x your CAC, so that's three times more of what you've invested in an initial product. In the world of SaaS, 3x is good, 5x is really good, and if you hit the sweet spot of providing the right service to the right guests, you can go the way up to 10x in terms of the lifetime value that you can draw from your customers.

Aldair: “If we look at just a 3x multiplier for a basic LTV, you can actually break the barrier of your CAC in just under 12 months. And that's just at a 3x multiplier. Once you're able to get the right target markets, and really get them coming back, and have that ricochet that we have in hospitality where people come back with their friends and their family, that amount gets shorter and shorter. So it's really worth investing that initial cost for acquisition.”

4. Monthly recurring revenue (MRR)

Achieving a consistently high monthly recurring revenue is like the holy grail for any SaaS or HaaS business. Hopefully, this shouldn’t need much explanation. When you have a traditional purchase-led model, you can’t necessarily rely on a steady income. However, that's exactly what subscription models can provide. Here’s Jirka talking about MRR:

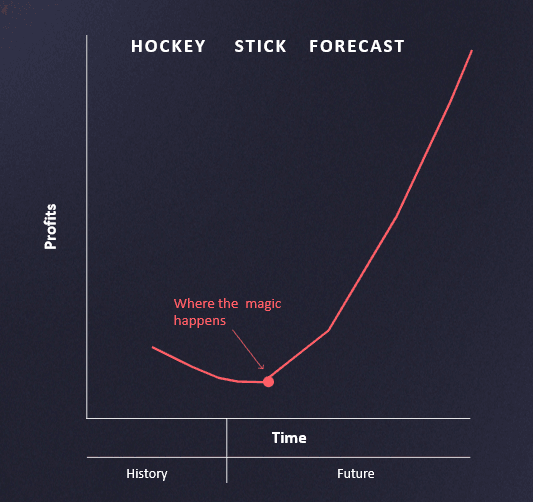

“Initially you will be spending a lot of money on customer acquisition costs to get a critical mass of members on board, but then if you hit the sweet spot, the magic happens there. From then, your revenue will copy the profile of a hockey stick.”

5. Net promoter score (NPS)

As you know, hospitality relies heavily on reviews. What we look at in SaaS is how likely are you to recommend someone's company or membership to someone else. And if people score you nine or 10, that means they were extremely happy that they had a wow moment. Then you basically convert your members into your sales army because they will spread the word to friends, colleagues, and online. Suddenly you will have new members coming in with very little cost of acquisition because the machine that converted them into your members was your existing members. It's very powerful.

6. Churn

“Whilst churn is often a really concerning metric, in some ways, it's also a good metric.” That’s what Aldair says, anyway. In the SaaS world, churn is a business that cancels their subscription with you, so in the HaaS world it would mean guests who cancel their membership. “Initially it's quite concerning to know some of your guests just aren't going to come back. Some of the facilities and services that you provided for them, maybe aren't for them, so and likely they're not your target market. So you should invest your resources on the guests that bring you the highest amount of revenue.”

Some churn is inevitable, and there are always ways to mitigate it, for instance: expansion revenue. Jirka: “You can always, after a year, when the member is really happy, try to upgrade them to a more premium membership. For instance, there could be an upgrade for unlimited coffee. There are ways how to think about extending the membership, and therefore expanding the revenue from the existing customer base. And then it's very simple: if that expansion revenue is growing faster than your churn, then you are safe. Your net revenue is a positive one.”

Rethinking space and occupancy

Another big theme that was covered extensively in the Realizing Your Property’s Full Potential Unfold session is the need to monetize every square meter of your property. Long-standing industry metrics like average daily rate (ADR) and revenue per available room (RevPAR) only cover one specific part of your building. Yes, it’s a crucial part, but there’s so much more you could be doing with your other space.

Why not convert your lobby into a living space where people can sit down, have a meeting, a coffee or even lunch? Why aren’t you monetizing all the spaces that you already have, whether it’s parking spots or empty rooms? Could you offer them to the public to increase your revenue? We've seen some hoteliers converting their rooms into rehearsal rooms for musicians. The possibilities are endless.

Hand in hand with this mindset shift is thinking about how we define occupancy. Traditionally, 100% occupancy means that each of your rooms is fully occupied overnight. But what about the day? What about your lobby and swimming pool and restaurant – are they being fully utilized?

"Look at the floor plan of your property,” said Jirka. “Really try to think about if this place is 100% utilized. Is all my staff serving someone at the moment? Are all the people who want a coffee, having a coffee, or do they walk outside and go to Starbucks? All these things are things that you need to think about. It's a big paradigm shift, but it's a step really forward towards utilizing your property up to its fullest potential.”

You can read more about true occupancy and datapoints like TRevPAR and RevPAG in the Metrics that Matter, our guide to becoming a data-driven property.

The rise of buy now, pay later

Payments have become easier and easier. We all have the expectation that when we make a payment, it needs to be fast and simple, and we've gone from shuffling payment cards in our wallets to handling digital wallets. The expected value of digital payments in 2021 was $6.6 trillion, and it’s expected to rise to $10.5 trillion by 2025. In fact, 84% of consumers expect to be able to buy what they want when they want, regardless of the payment method or the payment type that's accepted in a single location.

Since 2017, people have been stepping away from traditional credit cards because they don’t want to pay the interest fees. Instead, they’re choosing buy now, pay later methods, which you can think of in terms of buy now, sleep later when it comes to hospitality.

The trend is even stronger when it comes to Gen Z and Millennials: 43% of consumers between 22 and 44 years old want to have this buy now, pay later option when making a purchase. When this option is available for online shops, the conversion rate goes up by a huge 44%. It’s a trend that’s only going to continue and we’re watching it very closely.

What is Mews working on to support you?

There are lots of big ideas covered above, so how do we actually help hoteliers like you to reach this vision of hospitality? We’d need another few thousand words to cover this in detail, but it can be summarized by these five points:

- Improve Mews Guest Journey so it’s even more flexible and tailored to your guests

- Develop hybrid spaces that will help you improve occupancy and revenue across spaces other than beds

- Adapt to flexible time and move away from night-only reservations

- Embrace alternative payments including diverse methods and sleep now, pay later

- Nail cash management with easy reconciliation across multiple channels

Here’s Jirka with a final piece of advice: “Think about your property as the plane that's leaving every minute. The plane needs to be full, fully upsold, fully upgraded with all the coffee, all the meals, all the lottery tickets. Because although subscriptions are maybe a little bit further away, this is something that we all can start working on today. It's something that Mews is able to support you with, with existing functionality and it's something that will really try to help you recover from the ongoing pandemic.”

Written by

Tom Brown

When Tom isn't creating outstanding marketing content for Mews as Principal Copywriter, he writes fiction for himself. Either way, he only uses the best words.