Hotel deposit policies may feel like a headache, but they are one of the best tools hotels have to protect against cancellations, no-shows and unexpected costs. For guests, a hotel deposit is reassurance that their booking is secure. For hotels, it is a safeguard that helps maintain revenue stability.

This guide covers what hotel deposits are, the different types, why they matter, how they work, common challenges and how automation can make the process easier.

What is a hotel deposit?

A hotel deposit is an upfront payment that secures a reservation and protects the hotel against risks such as cancellations, damages or incidental charges. From a guest's perspective, it guarantees their booking and covers potential extras.

Most deposits are taken via credit or debit card. They can be charged directly or held as a pre-authorization (a temporary block on funds). Refunds or releases typically happen after check-out once the room has been inspected.

Types of hotel deposits

- A security deposit covers any unpaid charges or damages during a guest's stay.

- An incidental deposit is used for minibar, room service or other in-room purchases and charges.

- A damage deposit, sometimes called a breakage deposit, is held by the front desk in case repairs are needed and refunded after inspection at check-out.

- An advance deposit is collected at the time of booking, either partial or full payment.

- An early or late check-in deposit applies when guests want to arrive before standard check-in or leave after standard check-out.

Deposit vs. pre-authorization

While similar, deposits and pre-authorizations work differently.

A pre-authorization places a temporary hold on a guest's credit card to cover things like damages, incidentals or no-show fees. The funds aren't charged but are blocked until after check-out, when the hold is released.

A deposit, on the other hand, is an actual charge to the guest's credit card or debit card. It secures the reservation or covers potential charges and is usually refunded a few business days after check-out depending on the card provider or bank account policy.

Do all hotels require a deposit?

Not all hotels require deposits, but many do. Larger hotels, particularly business and luxury brands, often take them to cover extras or potential damages. Motels, boutique hotels or budget properties may skip deposits and rely on upfront payments instead.

6 reasons why hotels charge deposits

1. Minimize no-shows and last-minute cancellations

No-shows in hotels leave rooms unsold and impact revenue. A deposit discourages last-minute cancellations and helps protect income, since guests know they risk losing the deposit if they cancel too late.

2. Protect against potential damages or policy violations

By taking a deposit, hotels can protect against potential damages or policy violations like smoking in a non-smoking room or bringing a dog to a pet-free room. The deposit can be used for extra cleaning fees or repairs.

3. Cover incidental charges

Deposits let guests enjoy extras like dining, minibar or spa services without paying immediately. These incidental charges are then settled against the deposit at check-out, making the guest experience smoother.

4. Reduce the risk of chargebacks or disputes

Hotel chargebacks occur when guests dispute payments or lack funds. With a deposit, hotels have partial payment secured in advance.

5. Simplify payment collection

With a debit card or credit card already on file, deposits streamline check-in and check-out, saving staff time and reducing friction for guests.

6. Improve revenue predictability

Hotel deposit policies reduce uncertainty around last-minute hotel cancellations and no-shows, making it easier to forecast occupancy and revenue.

Common challenges with hotel deposit policies

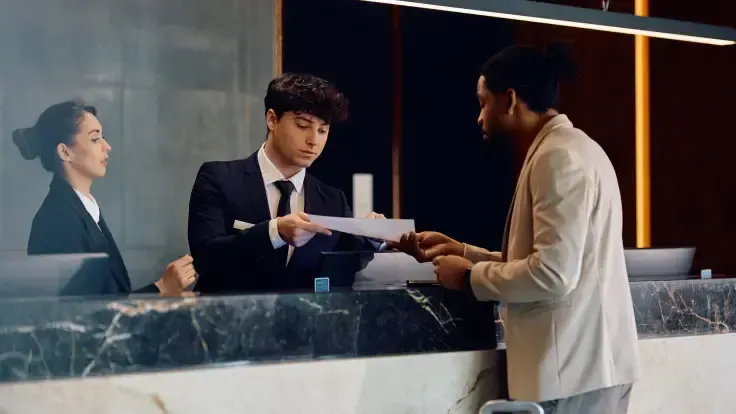

- Human error – incorrect card details or manual entry mistakes can block payments.

- Inconsistencies – without a standard policy, staff may charge different amounts for similar bookings.

- Poor guest communication – unclear language on when deposits are charged, refunded or held can damage trust.

- Risk of chargebacks – deposits may fail if guests don't have sufficient funds.

- Time-consuming admin for hotel staff – manual pre-authorizations or credit card entries create delays at the front desk.

How do hotel deposits work?

Hotel deposits are usually taken at the time of booking or at check-in. They can be charged directly or placed as a pre-authorization. Some hotels still accept cash deposits, though card holds remain more common. Funds are refunded or released once the guest checks out and the room is cleared.

Hotel deposit policy best practices

Match your deposit policy to your guests

Not every guest is the same, so your policy shouldn't be either. Business travelers often prefer streamlined pre-authorizations since they're paying with a company card, while leisure guests may value flexible hotel payment options. For international travelers, it's worth considering currency conversion and offering alternatives like digital wallets or cash deposits.

Align it with your cancellation policy

Your deposit rules should always reflect your cancellation policy. If cancellations are free, deposits should be refundable. If a booking is non-refundable, it makes sense for the deposit to cover the full stay. Consistency avoids confusion and builds trust.

Be fair with pricing and flexible with payment options

Guests respond better to clear, reasonable deposit amounts. A fixed percentage or the equivalent of one night's stay usually works best. Offering multiple payment options like credit and debit cards, digital wallets or cash makes the process easier for everyone.

Use clear language at every touchpoint

Transparency is key. Explain the terms upfront, from when the deposit will be charged, to how much, and when it will be refunded or released. Clarity reduces disputes and helps set the right expectations.

Think about factors like seasonality

You don't need the same rules all year. In high season or during peak demand, stricter policies may be appropriate, while quieter periods allow for more flexibility.

Train hotel staff to enforce your hotel deposit policy

Your staff should feel confident explaining the deposit policy to guests and handling exceptions when needed. Training them on how deposits and pre-authorizations work in your PMS is essential to avoid errors and ensure consistency.

Automating the hotel deposit process

Automation reduces the burden on staff and makes deposits easier to manage. With hotel payment systems like Mews, deposits can be automatically triggered, tracked and refunded within the PMS.

- Real-time payment processing across card types

- Automatic deposit holds and releases

- Stored card details for quick refunds or additional charges

- Integration with digital check-in and check-out

This improves efficiency, reduces errors and provides a smoother experience for both staff and guests.

Conclusion

Hotel deposit policies protect revenue, simplify payments and build guest trust. With clear communication and the right technology, they become a seamless part of operations rather than an admin headache. By automating deposits, hotels save staff time and reduce errors while focusing on what really matters – guest satisfaction.

Need help navigating payments in hospitality?

Download our guide "We Need to Talk about Payments"

Written by

Jessica Freedman

Jessica is a trained journalist with over a decade of international experience in content and digital marketing in the tourism sector. Outside of work she enjoys pursuing her passions: food, travel, nature and yoga.