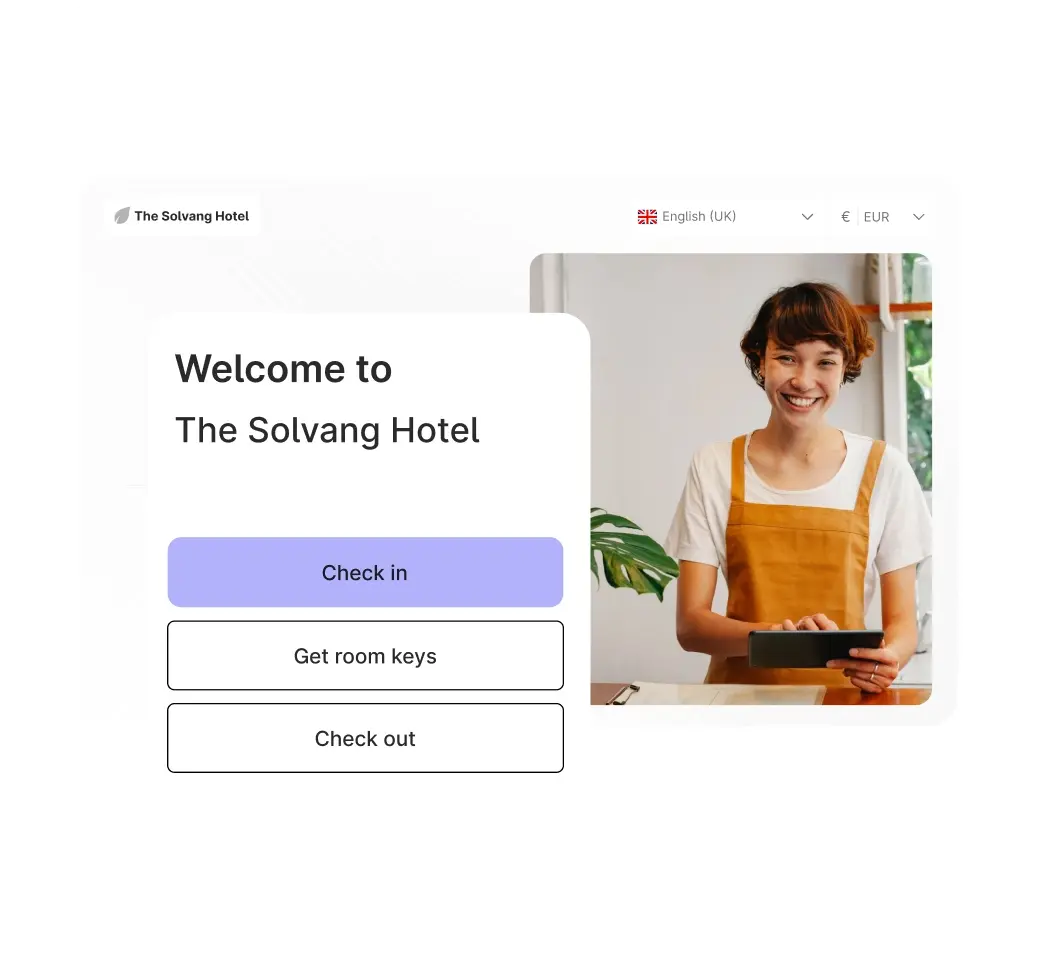

Automate hotel

payment processing

Mews Payments makes processing payments at your property fast, seamless and secure. Our embedded payment gateway automates payment tasks to save time, increase security and improve the guest experience.

.webp?width=519&height=519&name=Reporting%20render%20blue%20EN%20(1).webp)

/Good%20Hotel%20-%20EN.png?width=296&height=165&name=Good%20Hotel%20-%20EN.png)